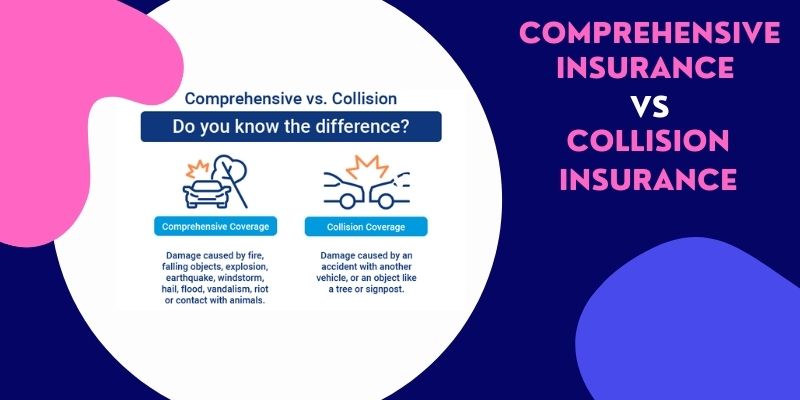

To fully protect yourself on the road, you must be familiar with comprehensive vs collision coverage. They are not mandated by law in any state, yet they may be helpful in many scenarios. Many insurance companies may provide packages that include both collision and comprehensive protection. Both cover costs associated with repairing or replacing a damaged vehicle, but neither would pay for medical bills or repairs to someone else's property if the accident were your fault.

Why Should You Obtain Comprehensive Insurance?

Just put it this way: mishaps occur. It doesn't matter how careful you drive; sometimes, things happen. A sudden downpour is always possible when you have to park outdoors. It's not uncommon to go late at night on a rural road when a deer darts in front of your car. These are beyond your control, but you can protect yourself by investing in full-coverage vehicle insurance.

Why Should You Acquire Collision Insurance?

However calm you may be when driving, other drivers on the road are always outside of your sphere of influence. Even the most cautious drivers are not immune to accidents. That's why drivers must get collision coverage. If you are involved in an accident with a motorist who does not possess insurance, collision coverage can assist cover the expenses of repair or replacement of your vehicle.

Should You Get Full-Coverage And Collision Coverage?

Comprehensive and collision insurance is a smart move for any automobile owner. Even while a car owner can avoid disaster by never using the vehicle or residing in a location with a meager chance of damage, misfortune may strike anywhere. Drivers based in more dangerous places should prioritize purchasing comprehensive collision insurance. If you happen to call Montana home, which WalletHub ranks as the worst state for drivers in 2022, perhaps complete but instead, what collision coverage is an absolute need?. 2 Somebody whose financial condition would not allow for unexpected expenditures like vehicle maintenance or replacement should also carefully examine both coverages, especially drivers of high-value automobiles who travel long distances.

The lender or lessor of your vehicle will almost certainly insist that you get collision and comprehensive insurance. That way, if your automobile is stolen or written off, you won't be able to walk away entirely from your loan but instead lease. Collision and comprehensive insurance are no longer required after the automobile loan has been paid in full. Even if you aren't mandated to, you may still want to get collision as well as comprehensive insurance. Can you afford to fix your automobile or purchase a new one if it were broken into or stolen? If you answered "no," collision as well as comprehensive insurance may help offset some of your losses.

However, as a car ages, the value you receive from a collision with comprehensive coverage may decrease. Your maximum insurance reimbursement in case of a complete loss or theft of your car will drop as its value does. Let's imagine you own a 2005 Honda Accord valued at roughly $3,300. With a $1,000 deductible, your insurance payout after a flood totals your automobile will be $2,300. You're the best judge of whether or not the cost of collision and comprehensive insurance over several years is justified by the protection it provides. According to the most recent National Association of Realtors statistics, the average accident claim is $4,412.31. A typical comprehensive insurance claim is $1,359.04.

What's Deductible?

There is usually a deductible associated with both collisions but also comprehensive coverage. If you claim your collision or comprehensive insurance, your deductible will reduce your payout. Deductibles often range from $250 to $2,000 or more. So, if you had a $2,000 claim for damages to your car and a $500 deductible, their insurance company would compensate you $1,500. The "diminishing deductibles" program is a perk provided by certain insurance companies to safe drivers. Under these plans, your deductible will decrease over time if you avoid making specific claims.

Conclusion

Both comprehensive versus collision coverages are add-ons that may help pay for repairs or a new car if yours is damaged, but they cover different risks. When you choose collision insurance, your vehicle is protected in the event of a collision with another car or object. In contrast, comprehensive coverage covers you in the event of unintended damage, such as a tree limb falling on your vehicle or striking an animal. Specific lenders may insist that you have collision and comprehensive coverage if you finance and otherwise lease your car.